Fascination About Insurance

Wiki Article

How Cheap Car Insurance can Save You Time, Stress, and Money.

Table of ContentsMedicaid Fundamentals ExplainedThe Ultimate Guide To MedicaidWhat Does Renters Insurance Mean?Unknown Facts About Insurance

You Might Want Impairment Insurance Coverage Too "In contrast to what lots of individuals assume, their residence or vehicle is not their biggest asset. Rather, it is their capability to make a revenue. Yet, numerous professionals do not insure the possibility of a special needs," stated John Barnes, CFP and also proprietor of My Domesticity Insurance Coverage, in an email to The Balance.

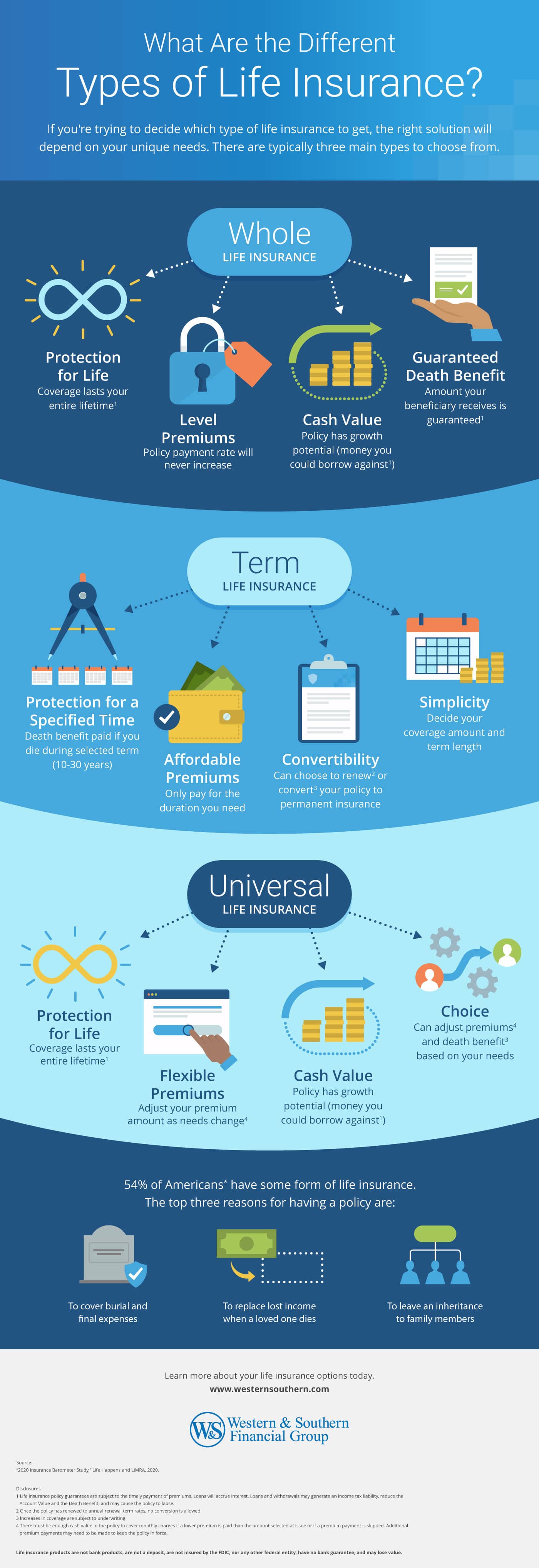

The information listed below concentrates on life insurance sold to people. Term Term Insurance coverage is the simplest form of life insurance policy. It pays only if fatality occurs throughout the term of the plan, which is typically from one to thirty years. The majority of term plans have nothing else benefit arrangements. There are 2 basic kinds of term life insurance policies: level term and also lowering term.

The expense per $1,000 of advantage boosts as the insured person ages, and also it clearly gets really high when the insured lives to 80 and also past. The insurance coverage firm might charge a premium that boosts every year, yet that would make it extremely hard for the majority of people to afford life insurance policy at sophisticated ages.

See This Report about Health Insurance

Insurance plan are designed on the concept that although we can not stop unfortunate events occurring, we can shield ourselves economically against them. There are a substantial variety of various insurance policies offered on the market, as well as all insurance companies try to convince us of the values of their certain product. Much so that it can be challenging to choose which insurance policy policies are really required, as well as which ones we can genuinely live without.Researchers have actually discovered that if the main wage earner were to die their household would just be able to cover their house costs for simply a couple of months; one in four family members would have problems covering their outgoings immediately. Most insurance providers advise that you secure cover for around 10 times your annual earnings - insurance.

You ought to additionally factor in child care expenses, and also future university charges if applicable. There are two primary kinds of life insurance plan to select from: whole life plans, and also term life plans. You pay for whole life policies until you die, as well as you pay for term life policies for a set amount of time published here established when you get the plan.

Medical Insurance, Health insurance coverage is another dog insurance one of the four major kinds of insurance policy that specialists advise. A recent study revealed that sixty two percent of personal bankruptcies in the United States in 2007 were as a straight result of illness. A shocking seventy 8 percent of these filers had medical insurance when their disease started.

Indicators on Life Insurance You Need To Know

Costs vary significantly according to your age, your present state of wellness, and your lifestyle. Vehicle Insurance policy, Regulation differ between different nations, but the relevance of car insurance stays constant. Even if it is not a legal requirement to secure car insurance where you live it is very recommended that you have some sort of plan in position as you will certainly still need to assume monetary duty in the case of a mishap.In addition, your car is often one of your most important possessions, as well as if it is harmed in an accident you might battle to pay for repairs, or for a replacement. You could also find yourself accountable for injuries endured by your passengers, or the motorist of one more lorry, as well as for damages triggered to one more car as an outcome of your carelessness.

General insurance policy covers house, your traveling, car, as well as health and wellness (non-life assets) from fire, floods, accidents, manufactured catastrophes, and also burglary. Different sorts of basic insurance consist of electric motor insurance, wellness insurance coverage, traveling insurance policy, as well as home insurance. A basic insurance coverage policy spends for the losses that are sustained by the insured during the period of the plan.

Check out on to know even more about them: As the house is an important belongings, it is important to secure your house with a proper. House and household insurance guard your residence as well as the products in it. A home insurance plan essentially covers synthetic as well as natural situations that might result in damages or loss.

Home Insurance for Beginners

It is available in two types, third-party and also extensive. When your vehicle is accountable for an accident, third-party insurance coverage cares for the harm caused to a third-party. However, you must consider one truth that it does not cover any one of your automobile's damages. It is likewise vital to note that third-party electric motor insurance policy check it out is obligatory as per the Electric Motor Vehicles Act, 1988.

A a hospital stay expenditures up to the sum insured. When it involves health insurance, one can select a standalone health and wellness plan or a family advance strategy that provides coverage for all relative. Life insurance policy gives coverage for your life. If a situation happens in which the policyholder has a sudden death within the regard to the plan, then the candidate gets the amount assured by the insurer.

Life insurance coverage is different from general insurance coverage on numerous criteria: is a temporary agreement whereas life insurance is a long-lasting agreement. In the instance of life insurance, the benefits and the sum ensured is paid on the maturation of the policy or in the occasion of the plan owner's death.

The general insurance policy cover that is mandatory is third-party responsibility auto insurance policy. Each as well as every type of general insurance policy cover comes with a goal, to provide coverage for a specific aspect.

Report this wiki page